Over the past 6 months, Smallcap and Midcap stocks have delivered phenomenal returns, attracting a wave of retail and institutional participation. However, as valuations stretch and fundamentals lag, the market seems to be entering a phase of rotation — from overvalued smallcaps to fundamentally strong largecaps.

At Aknā Capital, our analysis suggests that the next 12 months could belong to largecap stocks, especially for investors focused on long-term wealth creation.

The Valuation Gap Has Reached Unsustainable Levels

- The Nifty Smallcap 100 index is currently trading at a price-to-earnings (P/E) ratio above 30×, while the Nifty 50 hovers around 21×.

- Historically, such wide valuation gaps have not sustained for long. Whenever this divergence widens beyond a point, largecaps tend to outperform in the subsequent cycle.

- Many smallcap companies have seen their prices rise 2x–3x in a short span, while earnings have grown modestly — a clear sign of valuation overheating.

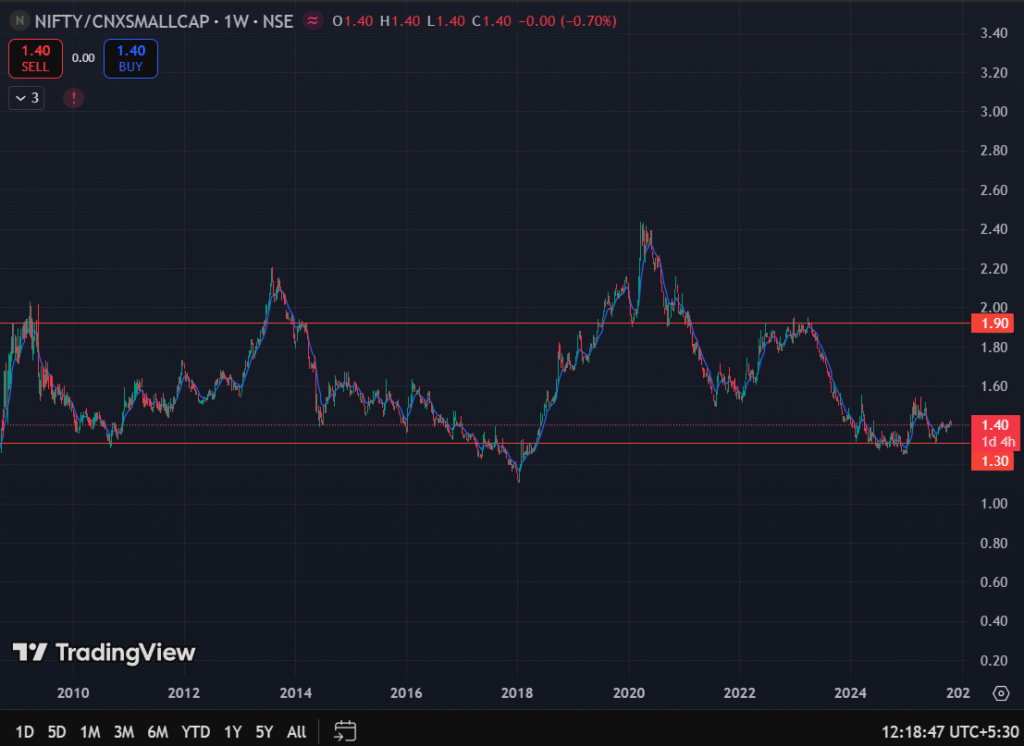

The Nifty-to-Smallcap Ratio Is at Its Bottom

The Nifty-to-Smallcap ratio, a reliable indicator of market rotation, is currently near multi-year lows.

Historically, every time this ratio bottoms out, it has signaled a phase of largecap outperformance over the next 12–24 months.

This suggests that the risk-reward equation has shifted — largecaps now offer more upside potential with significantly lower downside risk.

Earnings Visibility and Balance Sheet Strength Favor Largecaps

Largecap companies — especially in Banking, IT, and FMCG — are entering a period of steady earnings recovery.

- Banks are reporting record profits with improving asset quality.

- IT companies are stabilizing post a year of global tech slowdown.

- FMCG majors are benefiting from easing inflation and strong rural demand recovery.

These are businesses with robust balance sheets, strong cash flows, and proven resilience — qualities that tend to outperform when the market cycle matures.

Liquidity Rotation Has Already Begun

Recent SEBI alerts on the risks of smallcap and midcap overvaluation have triggered a gradual shift in institutional flows.

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) are increasing allocations to largecaps, where liquidity, governance standards, and earnings consistency are stronger.

This rotation of capital could further fuel largecap performance in the coming quarters.

Global Factors Support the Case for Largecaps

In a global environment of elevated interest rates, geopolitical uncertainty, and selective capital flows, FIIs prefer quality and liquidity.

Largecap Indian companies fit that description perfectly — offering growth, stability, and global credibility.

What Should Investors Do Now?

If you’ve been heavily invested in smallcaps and midcaps, this is the right time to rebalance your portfolio.

Consider gradually booking profits in overvalued names and shifting towards quality largecaps — businesses with leadership positions, consistent earnings, and pricing power.

Remember, long-term investing is not about chasing short-term rallies; it’s about staying ahead of market cycles.

Final Thoughts

Markets move in cycles — and after an extraordinary smallcap rally, the tide now appears to be turning.

For investors focused on long-term wealth creation, largecaps offer a more favorable risk-return profile for 2025 and beyond.

At Aknā Capital, we specialize in data-driven portfolio strategies that identify such market shifts early.

Our research blends macro insights, sector analysis, and fundamental strength to help investors make confident, long-term decisions.